News

18 Jan 2017

Software guru buys in to Jands

Subscribe to CX E-News

Richard White left Jands* in 1985 after leading development of the Aurora lighting console. His previous company Rock Industries was acquired by Jands in 1982 along with its staple range of Par cans, winchups and trussing. Richard is an engineer who knew software was the future, but with the CPUs of the day the Aurora didn’t have enough processing power. Whilst not a commercial success at the time, Jands continued to become a world leader in computerized lighting control.

When Jands director and significant shareholder Eric Robinson died in late 2015, his estate sought to sell the shareholding. Richard White has purchased a large portion of those shares, with some asset reorganization within the company giving the balance of control to the Mulholland family. (The other Jands entity JPJ Audio was sold to Clair Global in late 2015, with Australian shareholder Bruce Johnston staying on the share register).

In the intervening years Richard White established WiseTech Global which is heading to A$150 million turnover in FY17 with very rapid growth. It employs a large number of programmers and tech specialists at its HQ close to Jands near Sydney airport. Last year WiseTech Global was valued at over $1 billion when its shares were floated on the ASX, since then the market capitalization has grown to around $1.6 billion.

“Software is the new hardware”, Richard told CX as we toured the long rows of desks, each person sitting in front of 2 x 40” UHD monitors and connected to a server dungeon that has two generators on standby. We walk past the gym, café, and media room which is soundproofed so the company band can jam anytime.

He has a boyish charm and an affable manner which partially masks a ratchet smart mind, the product of parents who were engineers and event managers. He worked at their wedding reception venue as a teenager, and learned fast the value of service and innovation. Recently he bought the venue – historical Victoria House at Bexley – back again. There are signs of sentimentality here.

Richard has his roots in rock, playing in local Sydney bands and started a guitar repair business with Rock Repairs in the 1970s’. He maintains a ‘moderately substantial collection of guitars’, including Princes ‘cloud’ guitar (number 4). But he doesn’t have time to play in a band, as WiseTech will grow by as much as 50%. This year it expects an EBITDA profit of A$50m, which is remarkable.

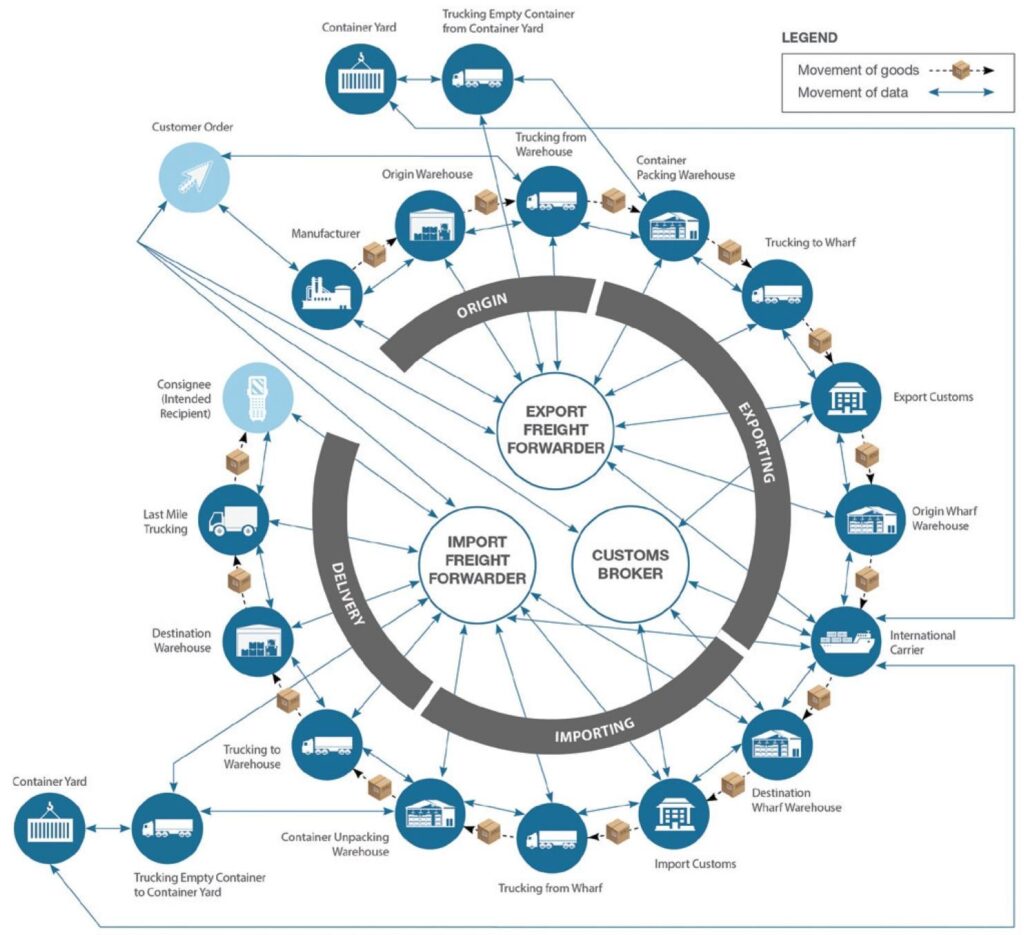

WiseTech made its name with CargoWise One, a system that executes all aspects of international freight movements and is used by global firms like TOLL, DSV and DHL. The customer retention rate is close to 99%. On all these numbers, the share price has climbed from around $3.90 to over $5.50.

So why float as a public company? Richard says it is the fastest way to build trust through transparency, and as an engineer of growth, he reasoned the extra funds for research along with the extra business doors that would open were mutually compatible.

There are pockets of brilliance all over the floor at WiseTech, from enormously focused math genius boffins to prototype telematics hardware that they plan to rent to trucking firms. Their system has modules that weigh axle loads, report tyre pressure, and connect to engine data to report when, where and what the rig is doing.

One big thing at WiseTech is the PAVE system; which stands for Productivity Acceleration Visualization Engine. Displayed on strategic monitors across the floor, it presents as a colourful set of columns and cells, each of which is a team, and each of which shows progress on tasks. Some underlying screens have bewildering graphs and more, but essentially it helps everyone know what everyone else is doing. Or not.

(Image below: from ‘Why the WiseTech Global share price has soared’)

Why buy into Jands?

“It’s a great business that has been very successful for a very long time. And I know the business and trust the guys”.

Richard was at pains to stress that his priority is WiseTech Global, and he will only assist Jands where they have need, and he is not a knight on a white horse. “I only bring an outside point of view, and to see what is possible.”

One thing that is on the horizon is a property development of the two Jands sites at Kent Road Mascot which could become a high-class technology park – something Richard knows about since WiseTech’s current premises sprawl over several buildings nearby. “If it’s right for WiseTech, and for Jands and if the boards agree, we and many other Australian tech companies could move in to a built-for-purpose tech estate”, he muses.

*Jands are an institution in the audio, lighting and staging industry across Australia.

Subscribe

Published monthly since 1991, our famous AV industry magazine is free for download or pay for print. Subscribers also receive CX News, our free weekly email with the latest industry news and jobs.